LE ROY PENNYSAVER & NEWS - JANUARY 19, 2014

Visit Our S

he Web:

Malovich

Environmental

Tree Trimming

Tree

Removal

FREE ESTIMATES

Fully Insured

(585) 409-6509

2/9

TREE SERVICE

ALL WORKMANSHIP GUARANTEED • INSURED

297-9097 • 768-7737

• Interior Painting

• Plaster/Lath Restoration

• Drywall & Drywall Repair

• Texture Removal

• Floors Stripped

& Refinished

• Old Ceilings & Walls

Made Like New!

Mike Darby's Patch & Paint

1/19

CDL B Drivers needed in Wyoming & LeRoy

with Tanker and Hazmat!

Our Tankwagon Driver is responsible for the safe

and timely delivery of product to our customers.

They will deliver, load and unload petroleum into the

bulk truck and end use containers while providing

exceptional customer service and maintaining

the highest safety standards.

If interested, please e-mail a resume to

OE

1/24

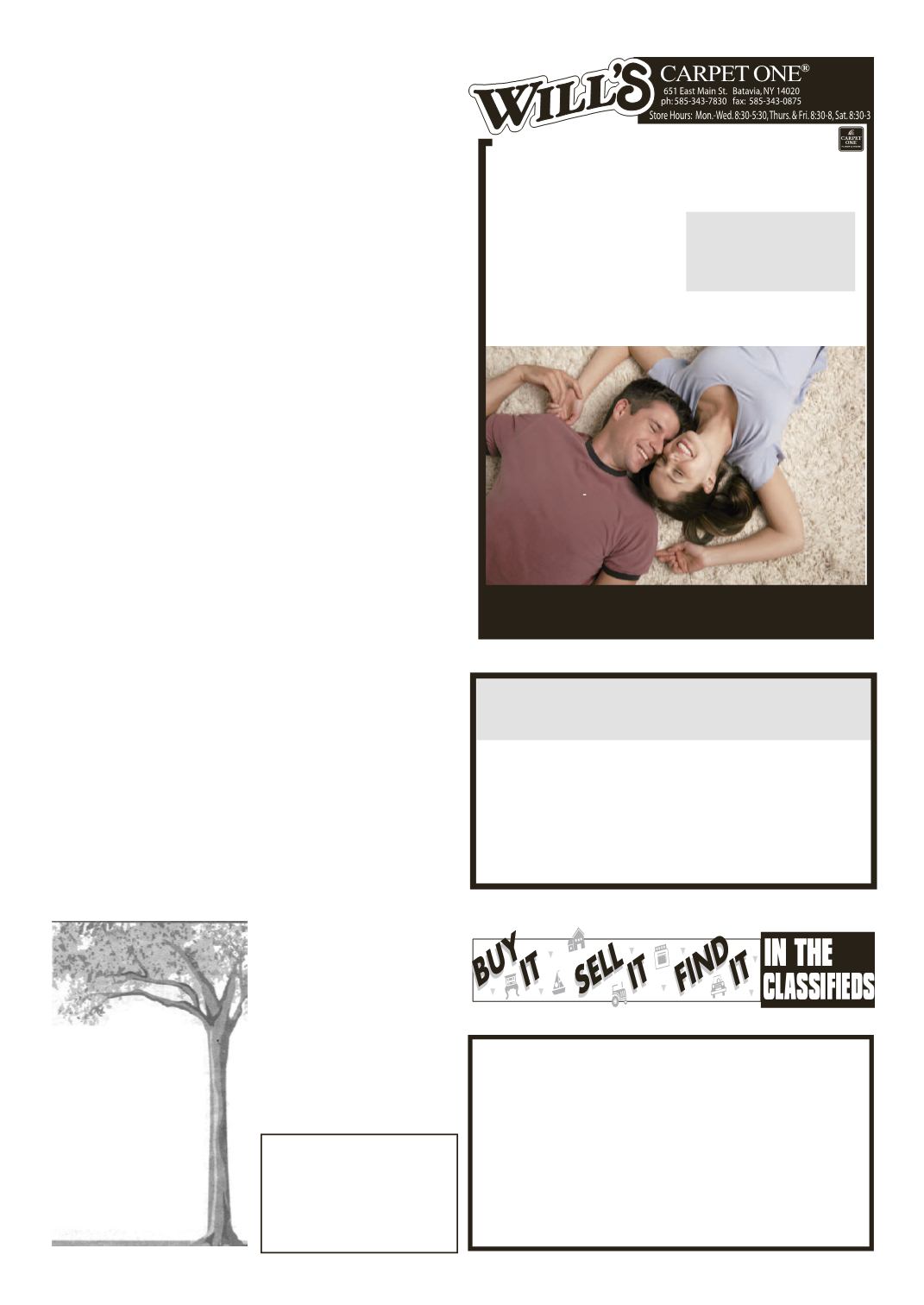

On Select Styles

Throughout The Store

Starting at

$

3.89

sq. ft.

Installed with a 6# pad

Ca

Sale

Hurry, Sale ends February 8th.

Financing Available For Qualified Buyers

Free Estimates

1/19

by Senator Ranzenhofer

January 2014

The New York State Senate

convened last Wednesday at

12:15 p.m. for the first time in

2014 to officially begin this

year’s Legislative Session and

to receive an update by Governor

Cuomo on the State of the State.

The message of the annual

address could be summarized

best by two words: tax relief.

The Governor’s presentation

outlined a series of tax relief

initiatives, including a two-year

freeze on property taxes, lowering

business taxes, eliminating taxes

for Upstate manufacturers and

accelerating the phase-out of the

utility tax.

These proposals have the

potential to continue chipping

away at New York’s high tax

burden, just as enacting a

property tax cap and reducing

income taxes rates started that

process a few years back.

I am pleased that the Governor

followed the lead of the report

released by the State Senate last

fall. Many of the Governor’s

proposals were outlined by

The

Tax Policy Review and Reform

Initiative

, and I have been an

advocate of many of these

initiatives for several years now.

Eliminating the corporate

income tax rate for Upstate

Manufacturers, and creating a

new tax property tax credit for all

manufacturers, would reduce the

tax burden on those companies by

more than $160 million. Merging

the bank tax into the corporate

franchise tax, then lowering

the rate to the lowest level in

more than 45 years, would save

businesses hundreds of millions

of dollars.

Accelerating the phase-out of

the 18-A surcharge (the utility

tax) would put more money

back in residents’ wallets, while

helping to keep energy costs

down for businesses. Freezing

property taxes would further

enhance the two-percent property

tax cap implemented years ago,

providing almost a billion dollars

in property tax relief back to

beleaguered taxpayers.

For a small business or

manufacturer, tax relief will

help to grow our local economy

by enhancing a firm’s ability to

invest and create jobs. For a

homeowner or family, cutting

taxes will make it more affordable

to live in New York, creating

more opportunity.

Once the Governor has released

the details of his budget, I will be

workingwithmy colleagues in the

State Senate and State Assembly

to review these proposals. It is

important to note that I believe

that these proposals should be

just the beginning of providing

additional tax relief to all New

Yorkers at every level. Even after

enacting some, if not all, of these

proposals, much more still needs

to be done to lower New York’s

tax burden.

That is why cutting taxes

will continue to be one of my

major priorities, not just for this

legislative session, but for the

next one and the one after that.

Tax relief with the farthest reach,

and to as many New Yorkers

as possible, will help to ensure

a brighter, stronger and more

prosperous economy for Western

New York.

State Of The State:

More Tax Relief Is Still Necessary

Don't waste precious time

traveling around ...

SHOP LOCALLY!

Le Roy Pennysaver

Mon.-Fri. 8 am to 5 pm